In Short

The FURIA is complex system designed to cover all aspects of successful handling important issues, regardless of their roots and targets.

Based on best management practices in audit and security, FURIA gives you fair opportunity to implement efficient and highly cost-effective way of management and controls in complex, demanding and heterogeneous processes such as internal and external audits, regulatory compliance, internal controls, enterprise security, executive management, involving and dealing with shareholders, and much more.

So, what is the real target of the system?

Whenever you think that you “cannot deal with them”, that you are “missing important things”, that you are “held blind” due to ineffective or non-existing reporting – start thinking of FURIA as the cure. If you don’t see it yet in the text that you read up to now, you will see it for yourself in next few brief chapters.

The Meaning of

Well, you are aware that all good things have good names.

The name of the system FURIA comes from its prime roots and main idea. The name is born in early days when we started to think of it.

It is our product logo and the acronym: Follow-Up Reporting and Internal Audit

Looked cool at first sight, we accepted it within just a minutes. Some things do not need much thinking, they sound good in the very moment when they occur.

The Birth of

As you might guess, and you are right about it, the prime idea and main target was to develop reliable but highly flexible set of management tools initially intended and scaled for needs of Internal Audit departments.

In the world of expensive, unreachable, complex and non-flexible applications our idea was to create something that can respond to the real customer needs. If just look around about you can see, in general, just three things:

- either you cannot find the system that fits your needs so you must change your business processes to fit somehow to the hard-coded non-flexible systems;

- either you can find it as reliable and partially flexible system, but far more expensive that budget and common sense can afford it, designed for large-scale companies with same needs as you have but no problems to pay for the whole show;

- or you turn to internal development, highly depending on your own staff or outsourcing company, and your sense of predicting needs and capabilities.

However, the initial idea was so strongly accepted and so motivating for whole team, and it simply pushed us to think much wider than the Audit, which was initial scope. Far beyond it.

The Problem

Main issue we are targeting was typical issue that bothers not only all Auditors, and not all Audit Departments, but it most bothers The Management itself: how to manage large number of complex issues (audit findings, detected problems, identified errors, tightly related to costs) in a large or mid-size company with number of employees and departments?

Usually, in most of the large and mid-size there are budgets that can afford some expensive software to Audit Department, designed exactly for dealing with findings. That provide Audit Department with possibility to automate audit monitoring of implementation so called agreed actions. That process of continuous monitoring of finding statuses and their progress is typically called Audit Follow-Up (although the name may vary, that’s the usual name).

So, when your company have e.g. 3-4 executives that handle 3-5 main sectors, each with 2-6 departments, and even 2-5 smaller units within one departments – that makes relatively big number of people responsible for taking some important measures – corrective activities. Now, if you have typically 2-10 issues per each unit, total number of e.g. audit findings can rise to 300, 500 or more issues. Then, multiply this with 10-12 years. A lot of stuff to deal with and monitor, ain’t it?

Then you have for each issue at least one corrective action. For each corrective action it is defined at least one responsible person and a deadline.

Finally, you have hundreds and hundreds of important data waiting for you to – monitor and react timely each time when you detect that each responsible person exceeded his deadline?

Then real problems start. How to deal with it and in the large amount of data to recognize what is important, what is urgent, who is bad performing, who don’t care about the issues? Who responds timely to exceeding deadlines, who closes issues timely, where is concentration of risks?

Really tough thing to do, if you consider that all of that data is typically in one or more Excel sheets. Auditors do not pay attention on the issues after they write the findings; responsible persons usually forget that something important is coming with deadline in late October, and you as a Executive get some “prefabricated” or “altered” reports that don’t say much about important things, or you look at the stats that don’t say much about the important things.

Then you come to the formal reporting. Which format of documents will be used, how to handle compatibility issues, absence of uniform corporate visual style (not convenient for quarterly shareholders gathering). Moreover, each reporting are will have “its own data” and nobody can actually compare results and information from all organisational units across the several different dimensions, e.g. every shareholder likes “profitability reports” but rare are those who will compare it with current risks related to audit findings, noncompliance with the particular laws or fines that come from time to time. We recognize this as one more thing we solved within the FURIA project.

Another aspect is control of the reporting costs. Have you consider how much money the company throw on “building” reports for monthly Audit Committees, weekly Executive Board meetings, periodic Shareholders Assembly and so on? When we mention these costs we are actually targeting efforts to make these assemblies good and with proper, comprehensive materials only about the Audit reporting activities, not all other units in the company. Estimations from sample of three local mid-size banks in Serbia lead to conclusion that only for audit monthly reporting on Audit Follow-up costs (auditors man-days) grow more than 12 kEUR per year, having side effects such as additional loss of auditor-days just for the preparation of the periodic reports! For your convenience, these examples of calculations are available as downloadable whitepapers on FURIA Web Site.

On the top, nobody will probably notice (or some will ignore) that deadlines for some important issues are passed, so your company might experience fines or law suits. Nobody rose an alert, no notification to responsible persons and their superiors, or the alerts came too late. Aaargh!

The Solution

So, you gather your best team and talk loud about monitoring of pending or exceeded issues, timely notifications, supervising responsible persons to act timely, raising important issues before they go to unacceptable level of risk. What to do to make this work, finally?

Than you can expect proposal for some expensive, partially compatible, non-flexible systems, open-source or commercial issue tracking apps.

Typically, these things are pretty costly, or really expensive. Moreover, they will not suite your needs – such systems typically insist that you should change and adept your processes to fit the application environment. Aaargh, again!

Faced with the same things mentioned before, we decided to try to change it, to make things happen.

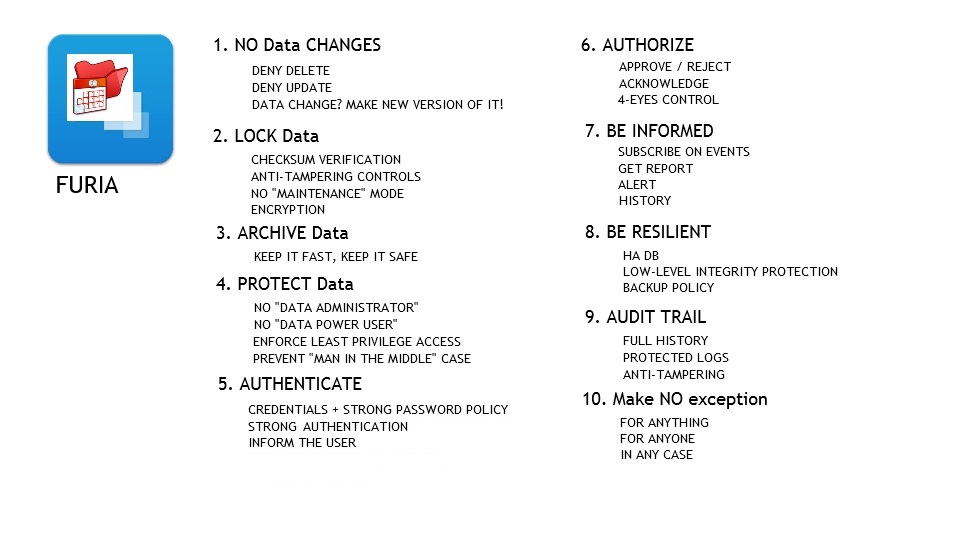

Overview of core principles we have decided to accepted in design and development:

After almost 9 months of detailed surveys and deep process analysis in several large and mid-size companies and banks, we made the efforts to design our vision of such system that will

(1) suite your needs without pressing you to change your organization,

(2) will be highly flexible, transparent and productive, and

(3) will be highly cost-efficient.

One year later, by the spring 2015. we announced our turn-key system:

FURIA – The solution that matters!

FURIA – The solution that matters!